Small Businesses are Being Strangled by Costly Government Regulations.

DEATH BY A THOUSAND CUTS

Small businesses are being strangled by costly regulations, laws, ordinances and mandates! Excessive mandates like minimum wage, workers’ compensation, unemployment insurance, licensing, have an especially negative impact on small businesses. The Regulatory Impact on Small Businesses: Complex, Cumbersome, and Costly (Based on report by the Bradley Foundation and the US Chamber of Commerce Foundation)

Read the Full Report: Click Here

The Regulatory Impact on Small Businesses: Complex, Cumbersome, and Costly

Based on report by the Bradley Foundation and the US Chamber of Commerce Foundation

Read the Full Report: Click Here

Death By A Thousand Cuts.

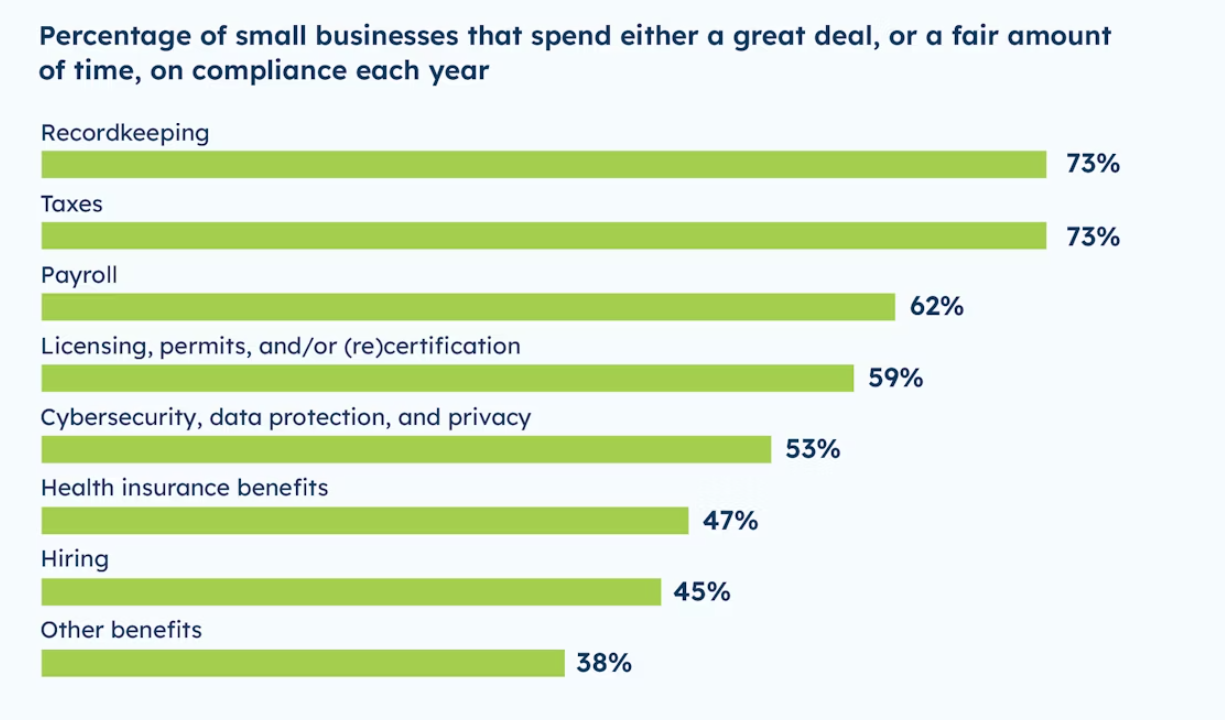

Across America, small businesses are the engines of innovation and economic growth. However, these job creators are increasingly strangled by a growing web of complex and cumbersome regulations at the federal, state, and local levels.

The regulatory costs of the largest federal rules alone total more than $40 billion, with small businesses shouldering a staggering 82% of these costs. State and local governments add to this burden with additional layers of regulation.

While requirements vary, regulations in areas such as minimum wage, workers’ compensation, unemployment insurance, and occupational licensing have an especially negative impact on small businesses.

According to the Small Business Administration (SBA):

- 99% of all businesses are small businesses.

- They employ almost 43.5% of all private sector employees.

- They contribute nearly 46.4% of private sector GDP.

Small businesses play a vital role in the American economy and are essential to the economic ecosystem. This is why the Chamber fights for free enterprise and the small business community.

Armed with these facts, citizens can advocate for needed reforms and make the political and economic case for effective small business regulatory reform at all levels of government.